Ideas As Capital

What makes an idea economically valuable?

*ANNOUNCEMENT*

Today, I introduce to you MENTAL MODELS. Our new form of content designed to pair as a perfectly juxtaposed complement to our weekly THOUGHT ESSAYS. While our Thought Essays are open-ended explorations for the intellectually curious folk that you are, our Mental Models take a different approach:

MENTAL MODELS (by Ideas Economy) are your pocket-sized blueprints for structured intelligence. Synthesised frameworks derived from current data, research, and cultural trends. Precisely curated to be easily applicable tools as you work and create.

Subscribers, expect a new MENTAL MODEL shared on the first Tuesday of every month.

Now, onto today’s reading…

This month’s mental model: Ideas as capital

Key idea:

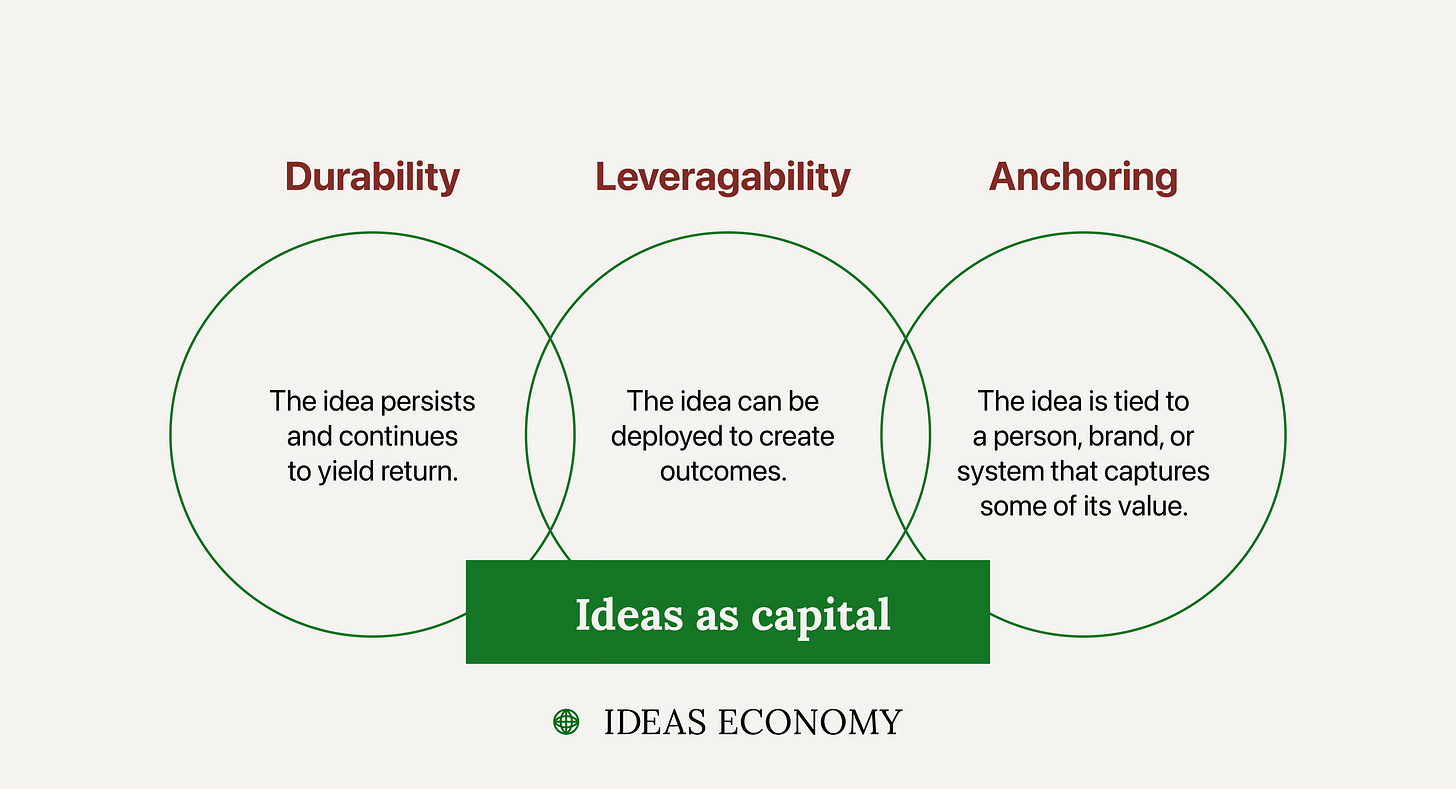

Ideas are a form of capital that generates disproportionate value when nurtured, leveraged, and distributed. Like financial capital, their value depends on durability, leveragability, and anchoring, not just originality.

Core components:

Durability

Leveragability

Anchoring

Use it to:

Quickly assess whether an idea is worth investing in.

What qualifies as capital in an ideas economy?

In the information age, ideas scale faster than infrastructure and spread faster than products. People and businesses who invest in ideas as capital are the ones best equipped for future-readiness.

This is perhaps obvious. However, what is notable is that while we are well into the information age and just about ready for another growth spurt (thanks, AI), there is not much information out there on what we are dedicated to here at Ideas Economy: the capital of ideas.

A brilliant idea in a notebook produces nothing. The same idea, deployed structurally, becomes a business, a system, or a movement.

“Ideas should enable production to take place and magnify value created through production.”[1]

Not all ideas are automatically considered capital. For it to be capital, it must carry the characteristics that economic capital has. We can deduce this into three criteria:

Durability: The idea persists and continues to yield return.

Leveragability: The idea can be deployed to create outcomes.

Anchoring: The idea is tied to a person, brand, or system that captures some of its value.

This trifecta distils patterns across research papers, economic theory, and my own field observations. Much of it draws quite loosely to Kent Business School’s 2003 paper (yes, 2003) on ideas as capital (cited below, for the curious).

Ideas are capital because they – like other capital – facilitate the creation of value. Ideas are the enabler for the creation (or production) process to occur.

Next time you sense an idea could have commercial legs, run it through this framework. It might be more than an entertaining thought in your head. It could be the start of your next venture.

If this piece spoke to you, hit reply and share your views. I read every email reply and comment, and appreciate your feedback.

[1] Dean, A., & Kretschmer, M. (2007). Can ideas be capital? Factors of production in the postindustrial economy: A review and critique. Academy of Management Review, 32(2), 573-594.