Money and attention

Five shared principles in money, energy, and ideas.

Those who mismanage money tend to mismanage themselves. There is a tight, often underappreciated link between money psychology — how we think, feel, and behave around finances — and our capacity to treat our own energy and attention, and yes ideas, as a form of currency. At its core, both systems operate on similar principles: value, scarcity (or abundance), opportunity cost, and compounding returns. There are at least five perspectives by which to view this:

Perception of value: People with a fear-driven or scarcity psychology around their cash often undervalue their own time and energy, seeing them as expendable rather than finite assets that must be replenished intentionally. Conversely, those with an abundant, clear, and strategic view of money tend to recognise that attention and energy are the raw materials that generate all other forms of capital — financial, relational, and creative.

Investment mindset: Treating energy like money requires seeing it as an investment with potential returns, not just a cost. Just as financial capital is allocated to projects, assets, or instruments expected to yield more value, attention must be directed toward tasks, people, and experiences that compound impact over time. Someone who struggles with financial discipline often mirrors that in energy management, draining themselves on low-return activities.

Opportunity cost awareness: Financially astute individuals understand that every dollar spent has an opportunity cost. Similarly, recognising attention for the value that it has means appreciating that every moment invested in one activity is a moment taken from another. Sometimes, people might fall into a restrictive mindset, and in doing so will likely ignore these trade-offs, burning energy on unproductive obligations or shallow engagements, just as they might overspend on impulse purchases.

Self-limiting belief and entitlement: The way we handle money often mirrors one’s deep beliefs around their self-worth. Those who subconsciously feel less deserving of wealth or success tend to give away energy freely, tolerating draining environments or overcommitting to things. They might even find themselves hoarding in fear or — on the other end of the scale — spend recklessly to compensate for a feeling of inadequacy.

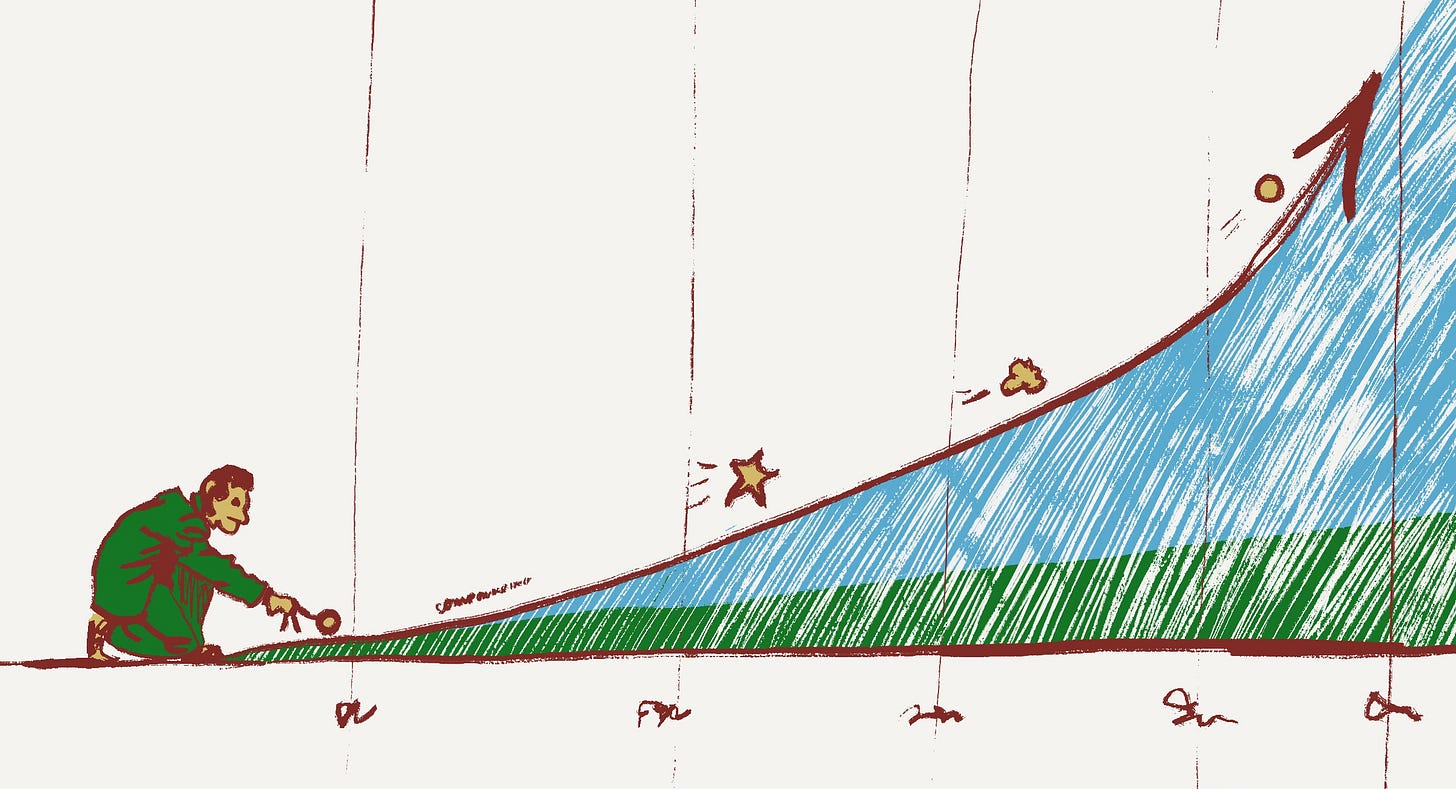

Compounding returns: “The eighth wonder of the world,” says Warren Buffet and subsequently everyone else in business and finance. Capital grows exponentially when invested wisely over time. Energy and attention compound in similar ways: learning, skill-building, and creative work generate long-term leverage, while wasted attention produces minimal returns, if any. People who understand compounding in money are more likely to apply it to their personal energy, knowing that the strategic allocation of focused energy today yields exponential future returns.

In brief, the way you handle money says a lot about you. It also speaks volumes to predicting how you are best equipped to value, allocate, and grow resources from your own gifts, ideas, and energy. With that understood, the logic is simple: for you to be a better creator (inventor, artist, engineer, designer, innovator-at-large), then start with your relationship with money. See where it stands now, and follow with how you might enhance it. Allow money to be the tool that enables you to better understand, and therefore more aptly respect, your inner economy of energy, attention, and presence.